Editorial: Apple, Google and the failure of Android's open

Open Source enthusiasts love to tell you Android is winning, and that it is winning because it is open. But they're wrong on both counts. The history of computing makes that abundantly clear, as do the current leaders in profitability.

The undelivered promise of open

The ideological allure of "open" is very strong. Really, who doesn't want technology to scramble ahead as quickly as possible, unfettered by the proprietary barriers erected by companies trying to make money? Except, of course, said companies trying to make money.

Years ago, I regularly argued that Microsoft's Windows monopoly would increasingly be encroached upon in two directions: from Apple on the high end, and from Linux on the low end.

I was only half right. Apple brought down WinTel nearly on its own, while Linux on the PC never managed to materialize as a significant threat to Windows on the desktop. Even Google's recent resuscitation of Linux as Chrome OS has had nearly zero impact on the world.

Today, Apple's iOS is, in a sense, the Windows of mobile computing. iOS is the platform developers are targeting, with other mobile platforms getting only the scraps of attention that are left over. Once again, we have a dramatic battle where the "Open Source" role of Linux is now being played by Google's Android.

And while Android's advocates would very much like it to be winning, the reality is that overall, products based on Android are not making money and not creating a solid platform because software developers are not making lots of money on it either. Most Android licensees are actively losing money.

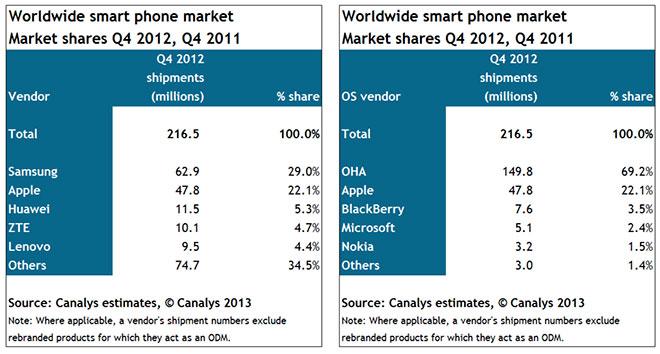

In large part, this is because "free" attracts lower value customers who don't want to pay for apps, services or hardware and who block ads. This population has helped ensure that both Android and the open web aren't very good at generating revenue. Across the entire web and Android, Google generates much less revenue than Apple does just selling the iPhone to roughly 22 percent of smartphone owners.

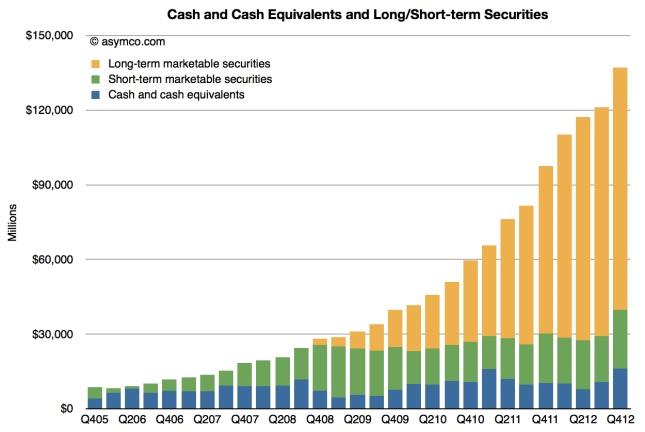

In total, Google earned just over $50 billion in all of 2012, including its Motorola hardware group. In contrast, Apple earned more than $54 billion just in the most recent quarter.

And while Google is struggling to enter the hardware business with its Nexus and Motorola brands, Apple is already skimming the most profitable cream off the top of the ad business with iAd even as it sits on the most valuable segment of the population that advertisers want to reach with iOS.

Less open, more profitable

The most successful fringes of Android are those that are the least open. Samsung is the world's leading Android licensee, and essentially the only really successful one. But it achieved that success by layering Android with proprietary designs and features and marketing its products identically to Apple.

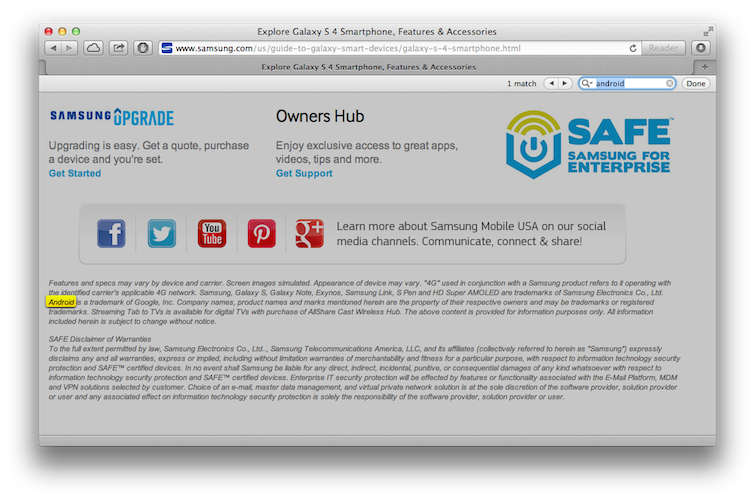

When Samsung markets its Galaxy S4 and Note 2 flagships, it doesn't advertise that they run the same Android OS as the HTC One and the LG-built Google Nexus 4. It advertises is own proprietary software features like Air Gesture, its S-Pen, its S heath add-ons and its SAFE Knox software, none of which is shared with the Android community.

Saying that today's Samsung is successful because it is "open" with Android is like saying that today's China is successful because it is Communist. In reality, their recent successes are due to both having stepped away from communal planning and designs and toward proprietary, differentiated, private investment of capital.

Samsung isn't successful because of Android, it's successful in spite of it.

Further, Samsung is working to be less "open" by partnering with Intel to deliver Tizen, the latest effort at launching Linux for mobile phones in a way that is "open" at the core but which can be used to deliver even more proprietary, differentiated products than Google's communal Open Handset Alliance for Android.

"Open" software doesn't necessarily have to be open, just ask Motorola, which once sold Linux phones in China that were in no way open whatsoever. Motorola just used open source software as a way to sell proprietary devices, the same way that Google sells proprietary advertising services using open software, or as Apple sells proprietary hardware that leverages open source software deeply buried at its core.

Open doesn't usually win

How successful Samsung's Tizen can be remains to be seen. It's the fusion of the ashes of previous failed attempts to deliver an open Linux distro for mobile developers. It also has many open predecessors that are not around anymore, including PalmSource ACCESS, OpenMoko, LiMo, LiPS and the closed version of Linux that Motorola used to sell on feature phones in China.

Being open also didn't save Nokia's once leading Symbian. Nokia took control of the Symbian platform and turned it into an open source foundation only to see its efforts stumble off into irrelevance, much the same way that Netscape "opened" its browser code to deliver Mozilla and Firefox, which exist only because third parties have dumped tens of millions of dollars a year down its rathole over the past decade.

Like any other failed communal experiment, the apparent successes dry up and blow away as soon as you stop heavily subsidizing the operation with cash it couldn't otherwise earn on its own.

If you're making a score card of how often "open" has won in the mobile world, it's not performing very well just on its ideological credentials alone. It's certainly not a magical path to success. And historically, being "open" has generally served as a way to transfer one's value to other parties and then go out of business.

Everyone is open when and where they're not making money

Apple's iOS and the OS X it was derived from are built on an open source foundation, albeit if anything, less open than even Samsung's version of Android that's iced with thick, proprietary layers on top.

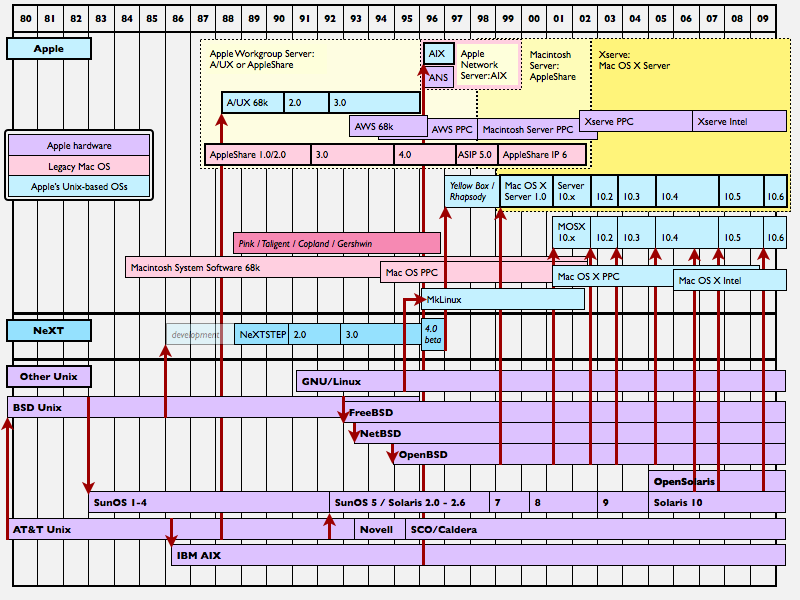

Some significant portion of Apple's success with MacBooks over the past decade was certainly due to OS X's ability to serve as an excellent version of Unix, a feature that attracted many open source enthusiasts and developers who wanted the familiarity of an open Unix system with the slick integration of a well designed, proprietary product. Open software has historically resulted in a primordial soup from which real winners emerge through proprietary activity.

So rather than "open" being a binary condition that makes companies who claim adherence to it successful at the expense of those who are "closed" and proprietary, the reality is that successful companies can adopt open software in areas that make sense, but they will derive most of their profits from proprietary activity.

And when you look at the world realistically, Google is making its money through proprietary activity in placing ads in front of audiences, just as Apple and Samsung make their money by layering proprietary hardware and software technologies over an increasingly less significant open source core.

Rather than being a key to success (espoused in the mantra, "open always wins"), open software has historically resulted in a primordial soup from which real winners emerge through proprietary activity. Stay in the soup and you don't develop, nor do you make any money.

Evolution out of the FOSS pool

In the earliest days of personal computing, the first platform you could call open is probably CP/M, which was simply a work-alike system that was shared by a lot of personal computers, fostering compatibility between them.

Microsoft's initial claim to fame, in 1981, was to "embrace and extend" CP/M into a proprietary MS-DOS it could make money on by licensing it to PC makers. Microsoft worked hard to prevent alternative versions of DOS from selling, much the same way that today Samsung has little interest in helping out its fellow Android licensees sell hardware.

MS-DOS was widespread when Apple released its Macintosh, which introduced an entirely new way to work that was proprietary to Apple. The Mac was so much better than DOS for some activities that, despite winning minimal market share, it could grab a significant profit share.

However, Microsoft subsequently appropriated much of the proprietary value of the Mac and began selling it to its established DOS licensees as Windows. Apple clearly lost much of its potential sales for Macs because there was an "open" alternative that was available across a number of PC makers.It wasn't "openness" that made PCs more successful than Macs throughout the 90s. It was economies of scale funding proprietary advances.

But Apple didn't lose out in the 1990s because it was "closed instead of open." It lost out because its proprietary value was forcibly cracked open by Microsoft, which then successfully resold Apple's work as a proprietary offering. Calling this a triumph of "open" is like calling burglary a triumph over ownership.

Apple simply couldn't compete against the economies of scale that were feeding the DOS/Windows PC; it at least did a very poor job in trying. The end result was that Apple only retained a relatively small niche business throughout most of the 1990s.

While you can describe WinTel as "open" in comparison to Apple, it wasn't "openness" that made PCs more successful than Macs throughout the 90s. It was economies of scale funding proprietary advances, not openness, that kept Windows PCs profitable and dominant. There were other "more open" platforms that couldn't compete with it either.

Open fails at NeXT, Apple and Palm

The failure of "open" was even more evident outside of the not-very-open WinTel world. In the late 80s, Steve Jobs' NeXT had also attempted to take the value of the Mac, combined with the "openness" and market for Unix workstations, and deploy it as an advanced computing system.

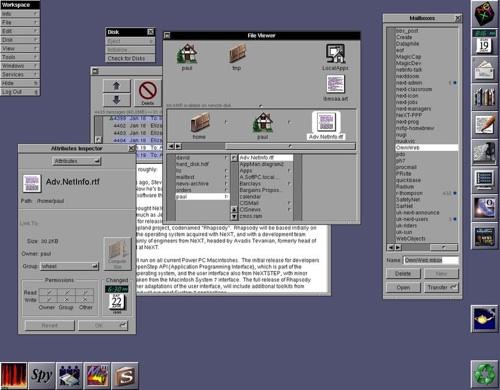

Once the economies of scale favoring PCs became obvious, NeXT switched from an Apple-like hardware model to a Microsoft-like software model. That "openness" didn't help. But even more radically, NeXT then turned to an open specification model, one quite similar to today's Android.

Under this model, NeXT planned to work with HP, Sun and other major workstation vendors to develop OpenStep, a standard windowing environment that anyone could adopt. NeXT would sell its own software as an implementation of the specification, and developers could build apps that would work anywhere, even on top of Windows running an OpenStep shell.

OpenStep largely failed because Sun pulled out of the partnership and copied the most valuable concepts of the OpenStep specification to deliver Java, a write-once, deploy anywhere strategy with lower barriers of adoption.

Despite giving the world an advanced and very open computing environment, Jobs' OpenStep didn't go anywhere. NeXT eventually was acquired by Apple and became the foundation of OS X, giving the aging Macintosh a new lease on life. Jobs, and Apple, learned some additional, powerful lessons about the nature of being "open."

Prior to Jobs' return, Apple had also learned some of its own lessons regarding open platforms. In the early 90s, Apple launched Newton Message Pad handheld tablets but also licensed its Newton OS mobile technology to other companies, including Motorola and Sharp, in a program similar to today's Android.

Apple then attempted to also license its Mac OS to Panasonic, Bandai and other hardware makers for use in both computers and game consoles, all without much success.

Palm, which in the late 90s had delivered a smaller, simpler and cheaper alternative to Newton for PDAs and later smartphones, also tried to license its Palm OS to Sony and other licensees much like Android, before also running into the same issues of stagnancy, fragmentation and competitive issues that Android is now facing.

The open failure of Linux

NeXT's Android-like OpenStep isn't the only ambitious effort to openly offer sophisticated technology that has failed. Failure occurs more often than not. "Openness" also doesn't help avoid failure.

In the first half of the 1990s, Novell's Ray Noorda attempted to build an open source arsenal around AT&T Unix and Linux that failed to ever take off.

In 1996, the remains of his efforts were spun off as Caldera, which similarly attempted to create an OpenLinux specification for desktop users as an alternative to Microsoft Windows. By 2002, Caldera had refocused its efforts to target the Enterprise with United Linux.

Despite all of these Android-like, global initiatives to partner with and support Linux on the desktop, in the Enterprise, and, by 2005, on mobile devices (OpenMoko, LiMo and the beginnings of Android), there was no success to be found in simply being open, whether in the sense of open source, openly developed, or openly licensed.

Commercial success was being achieved by companies who had a proprietary edge: Microsoft had its Win32 APIs for creating Windows apps; Apple was making some money from its Mac OS; and Nokia, Palm and Blackberry were making money with mobile platforms that incorporated some open source elements, but crafted value from proprietary hardware or software.

Android appropriates Java

Sun attempted to target the nascent smartphone market with Java, and successfully claimed significant market share through open licensing. But this wasn't tremendously lucrative. It was simply a primordial soup that begged for exploitation by more sophisticated predators.Google's Android did to Sun what Sun had earlier done to OpenStep: appropriate its valuable concepts and turn them into a competing platform.

Sun's Mobile Java was eventually targeted by Google's Android, which did to Sun what Sun had earlier done to OpenStep: appropriate its valuable concepts and turn them into a competing platform.

Sun had originally developed Java to help sell its server hardware, but then moved on to simply license it to smartphone makers. Google developed Android to sell its ads, so it could undercut Sun's Java by offering it at zero cost. Android has now eaten up all of the market that Java once dominated.

However, while Android was in development, Apple developed its own iOS platform, which has eaten up not just significant market share but has also syphoned off the vast majority of the global phone industry's profits.

By any measure that involves dollar signs, iOS is trampling Android. It supports third party app development better, it satisfies users better and therefore sells hardware better, it handles security threats better, and conveys these advantages by being "closed" and integrated. Openness on Android has been, so far, largely a liability.

Android fails, even when free

Android's ability to replace Java isn't very impressive given that it was both technically superior to Java and free. But Android's ability to outsell iOS is even less impressive, because Android has only flourished in areas and among populations where Apple's iPhone hasn't reached, despite being a "free" platform.

Among the higher end markets for modern smartphone hardware that Apple operates in, iOS reigns both in market share and mindshare. Apple continues to make the most money even when you throw in millions of low end smartphones and feature phones running Android in the developing world.

Additionally, the cost of Android is going up due to new patent licensing requirements. So Google's strongest advantage of being able to broadly spread its ad platform across smartphones by virtue of the core OS being "free" is now eroding away.

Anyone who thinks Google has a Windows-like advantage over iOS and will repeat the 1990s is living in the wrong decade. We're observing a repeat of the 2000s, where Microsoft lost its dominance by desperately trying to support global hardware makers with a PC specification that simply could't move as fast as Apple's OS X because it was weighed down by hardware fragmentation and malware patches.

If Apple could win over the global efforts of an entrenched monopoly in PCs with well designed Macs (and Apple is certainly making more money than Microsoft now), it's hard to understand why so many people who witnessed Microsoft's fall are betting that Android won't continue to be hamstrung by similar issues.

This is particularly the case because Android has a weaker market position than Microsoft ever did, Google makes nearly nothing on Android compared to the licensing revenue Microsoft commanded, and the Android platform has never been taken very seriously by software developers, in stark contrast to the lingua franca that Windows long was for PC software.

Free, open and failing to generate revenue: the Web

The greatest example of a successful free and open product must certainly be the Internet, and particularly the web. But while lots of companies have supported their businesses with a web presence, the web itself isn't making anyone lots of money apart from Google, which sells the most web advertising.

The emergence of the web handily beat "closed," proprietary online services that once existed, including CompuServe and AOL. But something new is happening on the mobile web: it's being overshadowed by a closed, proprietary platform for web services: Apple's App Store.

Developers are making money on App Store titles, far more than they could make selling HTML5 applets on the web. There's little money to be made on the web outside of ads (a business Google dominates) because everyone expects the web to be free. Click a Google link to a news story, and you're unlikely to pull out your credit card to pay your way though a paywall just to read the story.

On the other hand, millions of people are actively buying apps through Apple, which the company makes an increasingly significant profit from selling in the App Store.

Google, Amazon and Microsoft have their own mobile software stores, but they aren't seeing similar levels of revenue generating traffic. Earning profits is more important than spreading free software.

Just ask Apple whether it makes more money selling apps in iTunes to its own iOS user base or from widely distributing WebKit code to virtually every mobile device on the planet. Volume is not better than profitable revenues.

Google's ads threatened by closed walls

If success were simply related to spreading free code, Apple would be beating Android with WebKit. Instead, Apple is beating Android with iOS, which not only sells apps, but also sells profitable hardware (Android is not selling the Nexus Q, and Google's other Nexus products are not selling at high volumes or at high margins either).

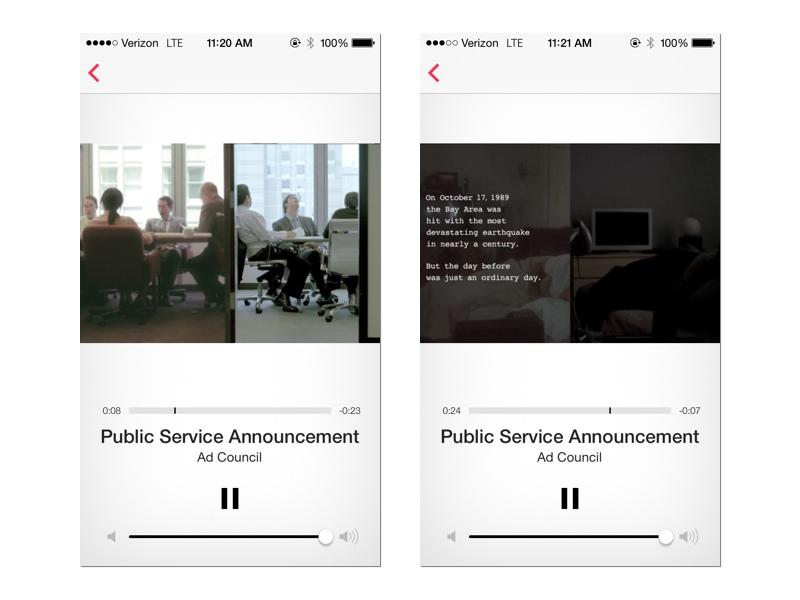

What Google should be increasingly concerned about is the fact that Apple is now encroaching upon its ad business. While Google has had little success spreading its ad savvy beyond web pages into "old media," Apple is gearing up to launch its iAd supported iTunes Radio, for free. It's not hard to imagine that iAds will someday appear to support video and TV programming, too (iTunes Radio also incorporates them, below).

But today, the real money is currently in iOS apps, and Apple is increasingly monetizing apps for its developers, even as it removes the web-like cookie tracking from iOS that other advertisers want access to in order to make their ads in iOS titles more valuable to advertizers.

So simply from the perspective of credible threats to the status quo, Google faces more potential for losing its advertising monopoly to Apple's iAd (and related) initiatives than Apple does in losing its hardware sales to Android as an openly licensed platform.

That's because "open" doesn't always win. It usually loses to greater competence, and often serves as the training wheels for the very vehicles that eventually run it over.

Daniel Eran Dilger

Daniel Eran Dilger

Malcolm Owen

Malcolm Owen

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele

Christine McKee

Christine McKee

William Gallagher

William Gallagher

Marko Zivkovic

Marko Zivkovic